INEOS Grenadier owners save $$$$ by not paying LCT

Luxury Car Tax (LCT) is designed to levy an extra tax on those people who buy luxury vehicles; the idea being that you don’t “need” a car that expensive and if you really want one, then you’ll pay extra tax for the priviledge. This kind of makes sense if you want say a BMW 5 Series instead of a Camry, but some vehicles simply cost a lot of money and the LCT thresholds don’t recognise that, just the outright cost.

One example of a relatively expensive vehicle is a working 4X4, and in this case specifically the INEOS Grenadier. At over $84,916 the vehicle crossed into the LCT threshold, and extra tax. However, in welcome news INEOS today said:

The ATO has recognised that due to the Grenadier’s design, engineering and capability, it is not considered a Luxury Car for tax purposes and therefore all Wagon models, options and accessories are exempt from LCT.Our configurator has been updated to reflect this decision, so you’ll notice any configurations you’ve been considering will have a lower drive away price due to the exclusion of LCT.

This will save customers quite a bit of money, in the order of $8-$10,000.

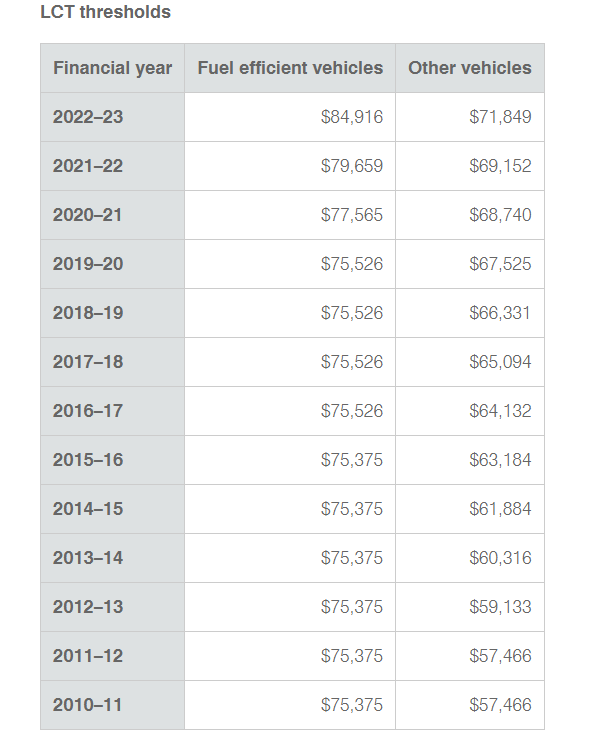

If you’re interested, the LCT thresholds are below:

A fuel-efficent car is one that has a combined-cycle fuel consumption of 7L/100km or less.

If you’re interested in the Grenadier, check out my interview with the local boss: