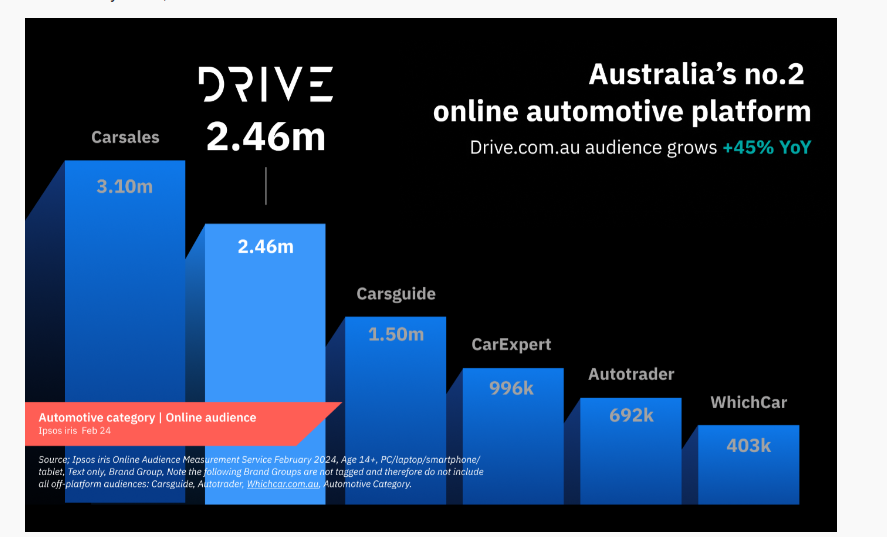

Which is the most popular “automotive platform” in Australia?

An email landed in my inbox this morning proclaiming drive.com.au as ” Australia’s second-most-visited online automotive platform in February 2024.”

That was interesting to me as I immediately wondered which the most popular “automotive platform” might be. Turns out, as per the title picture, it’s carsales.com.au. And, down in 6th place, is WhichCar, consisting I suspect of 4×4 Australia, Wheels and various other titles.

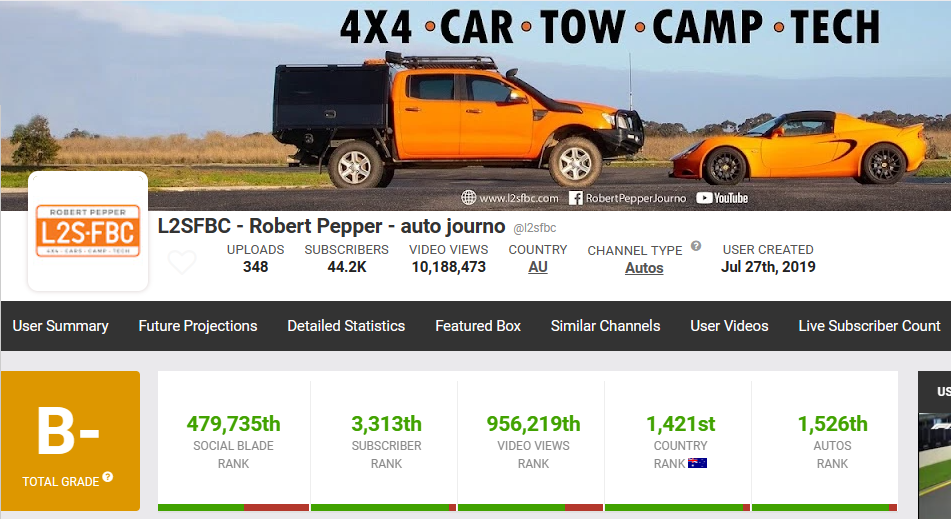

Now the interesting thing what one defines as an “automotive platform”, and this is where I think things are more than a little misleading. For example, in February my own channel had 411,000 visitors which would place me above WhichCar, and Feb was a slow month for me. But I’m not there. And more to the point, my channel is small relative to many others, so I went for a bit of a YouTube browse.

I have a browser extension called TubeBuddy which helps out with analytics, and one of the features is that is pulls data on other channels for comparison, so anyone can see what any given YouTube channel is doing. Here’s what it told me:

The yellow highlights are outlets as reported with the IPSOS data. I’m not clear exactly how they calculate their totals, but it seems to be total audience. EDIT: I’m informed by someone who should know that it’s website data only, not video, radio etc. Well, okay, why isn’t the title “web traffic” then, not “online” ? The blue rows are YouTube views only – dark blue are new-car focused sites, light blue general automotive and what I gathered using TubeBuddy, so those totals are under-reported given that doesn’t include websites or non-YT social media. I’m not sure if “audience” means unique visitors, or views – one person may visit multiple times generating multiple views, so how does that work for your audience figures? EDIT: it’s visitors not sessions, but again, that needs clarification because the unique visitor vs session/visit line has always been blurred. Regardless, even if we assume the yellow rows are unique visitors, pretty sure MCM would be smashing some of those yellow rows. And I honestly don’t know which is the biggest Aussie YouTube channel – any ideas?

This is what TubeBuddy reported for Drive.com.au:

That’s 1.06m for Feb, so I guess the other 1.5m or so would be their website which would be higher traffic than most. Many YouTubers would have minimal traffic on their website so the YT figures would be more representative, but do you count Facebook, Insta etc as well?

Now you could argue that my channel, and that of others like ASPW, is not an “automotive platform” if you define it as focused on new cars. So that’s why I looked up Chasing Cars, The Right Car and CarSauce, all of which are very much focused on new-car reviews and to my mind, comparable in intent to the ones ISPOS has listed. Why are they not included? Doesn’t seem fair to me. From the Drive.com.au press release:

“Australia’s core automotive editorial and car classifieds platforms recorded the following monthly audience volumes and category shares”. Okay, maybe that’s the out, you’re “core” or not. And what, in 2024, is a “classifieds” platform? Oh right, that’s a throwback to the days of newspapers running classified adverts. Not how things work today, pretty sure nobody under 30 would even understand the term. Facebook Marketplace is where it’s at for parts, and for used cars, you look first and often only at Carsales – which is why I think they’re the alleged #1, the effect of traffic from used car buyers and sellers not because their content is dramatically better than the others listed.

Then we look at ISPOS’s total for “online automotive” which is 11.6m, of which the platforms they’ve counted make up 9.1m, leaving just 2.4m for everything else automotive in Australia, noting the caveat about their definitions. Seems…low. So, when Drive.com.au says this:

” Ipsos iris would now serve as the key independent and trusted reference point that media buyers, advertisers and auto brands needed” – I’m going to disagree. Use SocialBlade instead”

The reality is that automotive content has shifted from print, to web, and now to video. In the age of video the leaders are no longer the classic automotive media brands like the ones listed (albeit CarExpert is new), it’s the video-led creators operating as tiny businesses who are getting the numbers and the eyeballs.

The world of PR and marketing hasn’t quite realised this yet, and I hope for the sake of those who rely on sponsorship and new cars that changes. It was pleasing to see Aussie Arvos on the Grenadier launch for example – typically the “big” media outlets create near identical videos which are neither entertaining nor technically informative, so watch one, watch them all, whereas the YouTubers each have very different takes on a vehicle or topic so there’s true variation. I’d never have done an AA style video, and nor could I if I wanted to, but they couldn’t do my style and that’s the way it should be for the benefit of the content consumer.

If you found this interesting you might want to read my Content Strategy.